Corporate Tax Planning

Make corporate tax work for youExpat Financial Advisor

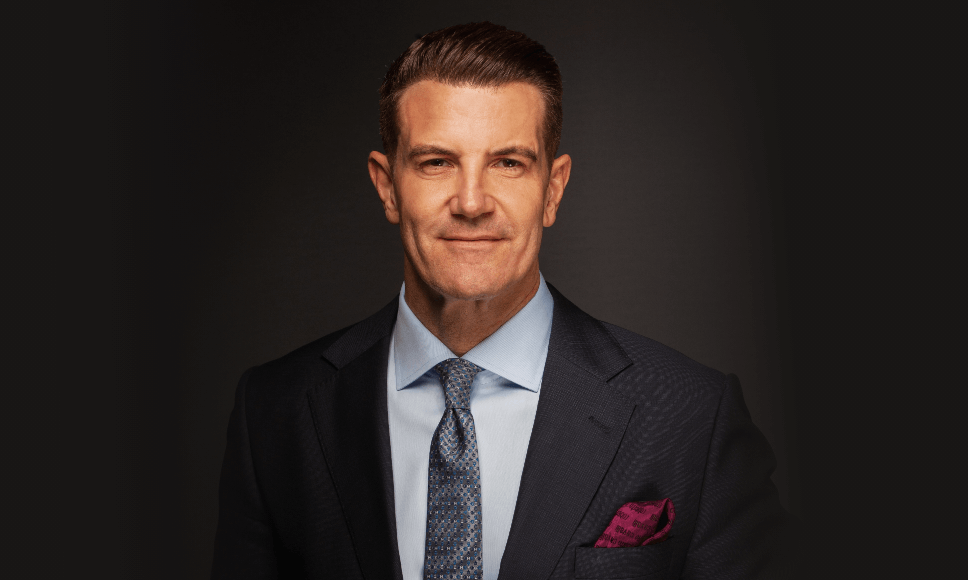

Mike Coady corporate tax planning ensures that your business can retain more profit and get more out of your business. Looking to organise your corporate finances in the UAE? Mike Coady is an award-winning corporate tax consultant in Dubai who helps large corporations manage and organise their finances for the optimum outcome.

What Can Corporate Tax Planning Do For Me?

Based in Dubai, Mike Coady is a fee-based financial adviser who is qualified to UK Financial Conduct Authority standards. With a strong 25-year track record, Mike Coady provides clarity for expat corporate executives.

With corporate tax set to be introduced across the emirates in 2023/4, it’s never been more important to review your options and see how your company can become more tax efficient.

If you’re an international business executive, there may be a number of advantages to getting in touch. Mike Coady can help you understand the benefits corporate tax planning has to offer and help you choose the ones that will work best for your business or corporation.

To get started you can get in touch today or book in your discovery meeting with Mike Coady.

Our Range of Corporate Tax Services

Tax Optimisation

Tax efficiency can be crucial to helping your business grow. Mike Coady’s knowledge of tax in Dubai ensures that he can give useful advice and ensure your business stays compliant but also tax efficient to save money that you can invest or plug back into your company.

READ MORE

Corporate Repatriation

If you’re looking to move your business from Dubai to the UK, there will be a lot of financial planning involved with such a move. This includes tax planning, to ensure you stay compliant and understand how the tax rules will change. Mike Coady can help you with corporate repatriation.

READ MORE

International Tax Wrappers

An investor can place a tax wrapper to shelter their investments from paying some or all of the tax. Find out more about this tax optimisation strategy and whether you and your business are eligible by arranging a call with Mike Coady today.

Who are Mike Coady’s Corporate Tax Planning Services for?

Mike Coady’s corporate tax planning service is designed for businesses based in the UAE.

Why Choose Mike Coady?

- Industry leader in the financial sector and expat expert in Dubai

- Award-winning money coach

- Qualified to UK Financial Conduct Authority (FCA) standards

- Member of the Chartered Insurance Institute

- 25-year track record of success in the financial services sector

- Over 100 5-star client reviewsFeatured as a highly qualified Financial Adviser

Find Out More About Property

43 Top Money-Saving Tips for Western Expats in the Middle East – A Comprehensive Guide

Navigating the cost of living as a Western expat in the Middle East can be a unique challenge,...

South Africa’s New Overseas Asset Transfer Regulations

South Africa’s Updated Regulations on Overseas Asset Transfers In a world where financial borders are becoming increasingly closer,...

South African Expat Tax Update 2024

South African expatriates should not only understand the newly implemented 2023/2024 tax laws, which aim at taxing their...

Schedule a call with Mike, your financial expert, today.

FAQ's

What happens at the Discovery Meeting?

Your 30 minute Discovery Meeting will happen over Zoom. It’s your chance to speak to Mike Coady himself and get to know how he can help you with corporate tax planning. It’s a no obligation, free consultation that gives you the chance to ask questions and find out more about Mike Coady’s services.

Do you pay corporate tax in Dubai?

Currently international companies do not pay corporate tax (except oil companies and foreign banks). However, this is set to change. This will become applicable across the emirates either on 1 July 2023 or on 1 January 2024, depending on the financial year followed by the business. For more information and to prepare for this change, book your Discovery Meeting with Mike Coady today.

Can a tax planning strategy bring value to my business?

Tax planning can bring value to your business. It not only ensures your company is following its legal obligations, it also ensures you’re not overpaying on tax.