Home Spousal Bypass Trusts: Mitigating the burden of inheritance tax

Spousal Bypass Trusts: Mitigating the burden of inheritance tax

Inhertiance Tax (IHT) is widely regarded as the cruellest of all taxes. This is because it is a form of double taxation and because it impedes individuals having the opportunity of passing on their full estate to their loved ones, such as children and grandchildren.

Unfortunately, Chancellor George Osborne is yet to fulfil his previous election promise of reducing the IHT threshold, which means (as incomes, pensions and property prices rise) a growing number of people are being pulled into the IHT net – a ‘net’ that was originally, when IHT was first introduced, only meant to affect the super rich.

However, the good news is that there are established measures that can be taken to mitigate the IHT burden. But it does take some careful pre-planning.

Below, I take a look at what we can do now to actively reduce inheritance tax liabilities.

Pensions, IHT and Spousal Bypass Trusts

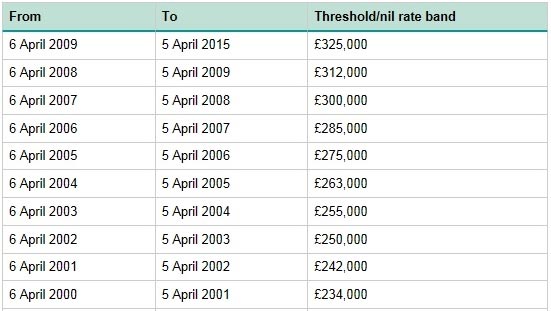

A pension will often be a person’s second largest asset after the family home and in many cases it will eclipse even that. When you include savings and investments in the mix, more often than not you will now find that people’s estates will exceed the ‘nil rate’ band of £325,000, over which inheritance tax of 40% will be due on death. This makes it really important to note that the nil rate band has been held now at £325,000 since April 2009 and it isn’t expected to be reviewed until April 2015. This is all whilst individuals’ wealth is continuing to grow which will bring more and more people into having to pay IHT.

If you take a fairly average size estate of £950,000 made up as follows you can soon see how wealth can easily accumulate to over £325,000;

Home £350,000

Cash £100,000

Investments £200,000

Pension £300,000

Total £950,000

Importantly, a married couple can transfer their assets on death over to the surviving spouse free from IHT. With any unused ‘nil rate’ band passing to the survivor increasing the nil rate band to a maximum of £650,000 (2 x £325,000). Ultimately, the excess of the survivor’s estate over £650,000 will be taxable at 40%.

With the above example there would potentially be an IHT charge of £120,000:

£950,000 less £650,000 = £300,000

£300,000 x 40% = £120,000 IHT

This is why it’s great that pension assets should not form part of the estate for IHT purposes so long as they are set up in the correct way. Unfortunately, failure to plan effectively means that sometimes these assets do get caught….and this means a higher tax liability occurs. It is vital the pension owner provides an expression of wish providing a nominated beneficiary. Importantly the nomination is not legally binding giving the trustees discretion to alter who receives payment as they see fit. In reality the trustees will almost always make payment to the nominated person(s) unless there are extenuating circumstances. This discretion is the essential feature which ensures the preferential IHT treatment of any payment.

Using an expression of wish to pay the benefits of the pension scheme in the example above would alter the calculation as follows:

£650,000 less £650,000 = £0

£0 x 40% = £0 IHT

The above assumes the pension holder is the last survivor and they are passing their wealth on to the ultimate beneficiaries.

It is important to also consider the scenario in which the pension holder dies first. They would probably prefer to elect for the benefits to be paid to their surviving spouse to provide for them for the rest of their life.

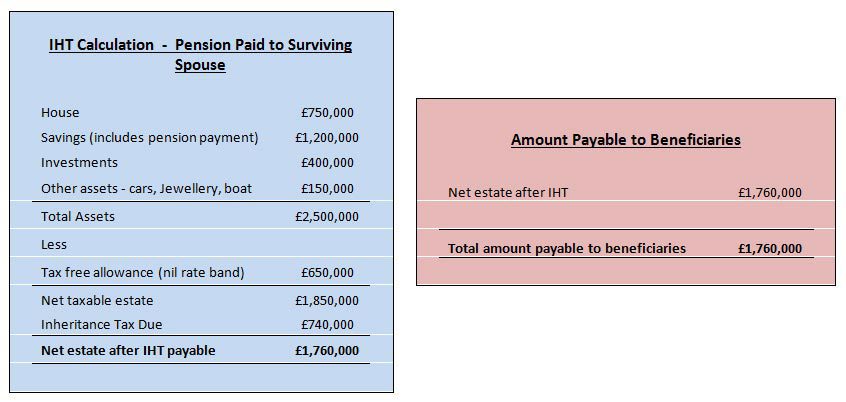

Dependent upon the type of pension and stage in the life of the couple on death the pension may either be payable to the survivor as a regular taxable income or a one off lump sum (which may or may not be taxable). If a lump sum is paid to the survivor then the money effectively falls into the estate for IHT! Reverting to the original calculation.

£950,000 less £650,000 = £300,000 x 40% = £120,000

This is where spousal bypass trusts come in.

Spousal Bypass Trusts

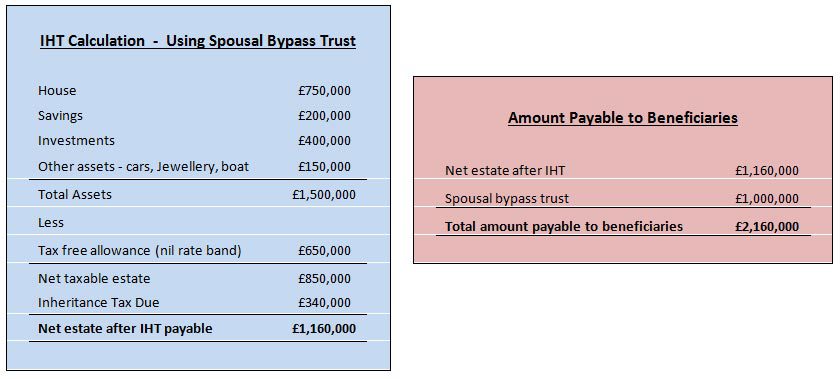

The lump sum death benefit from a pension can be nominated to a trust as opposed to a person. This means the lump sum can ‘bypass’ the survivor and the monies will not fall into the estate.

As a trust can be set up on a discretionary basis, the surviving spouse (if set as a beneficiary) will be able to receive payments from the trust to provide them with an income. This means they can benefit from the monies but importantly the full sum may never fall into their estate. This effectively drip feeds the money to the survivor meaning that the “bulk” of the funds remain in the trust and when the spouse dies become available to be distributed to the remaining beneficiaries of the estate.

The impact of a spousal bypass trust is better explained by a series of examples.

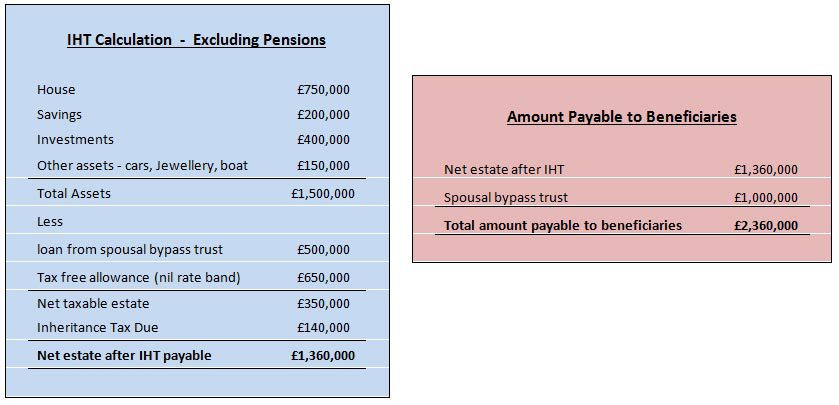

The example below shows how an estate with a surviving spouse is left a pension lump sum of £1,000,000.

Using the power of a spousal bypass trust should allow the pension to be paid into a trust keeping the large lump sum outside of the estate. This reduces the IHT and thus the amount paid to beneficiaries on the death of the survivor is increased by the saving! (some £400,000)

Clearly the spousal bypass trust can generate an IHT saving and help pass on wealth to beneficiaries. However….the benefit of using a spousal bypass trust can be “supercharged” by allowing the spouse to take interest free ‘loans’ from the trust rather than receiving discretionary payments. This works best when the spouse requires income from the trust and spends the loan creating a debt against the estate repayable on death, which further reduces the size of the estate and IHT due.

Using the previous example and assuming the spouse is provided with a loan each year of £50,000 for 10 years over which time assuming the trust generates a return of 5% (net of fees) the pension will retain its £1,000,000 value.

The planning can be enhanced even further if interest is set up on the loan repayable on death.

Pension scheme structure

The legal structure of the pension scheme will determine if the option of a spousal bypass trust is available. There are 3 main structures used to set up pension schemes:

- Irrevocable trust

This structure is used by most occupational pension schemes and many personal pension schemes (including SIPPs and stakeholder pensions). The scheme is established by a trust deed and the trustees normally have discretion over who receives the death benefit. - Deed poll or board resolution

This structure is used by some personal pension schemes. Here there’s no trust deed used to establish the scheme. However, the scheme administrator normally has the same power of discretion over appointing death benefits. - Insurance contract

This structure is used by retirement annuity contracts and buy out contracts. The contract is normally established directly between the individual and the insurance company. The policyholder owns the contract and the insurance company has no discretion over any death benefits.

The options available under these structures can be summarised as follows:

| Legal structure |

Bypass Trust |

Assign to trust |

| Irrevocable trust |

Yes |

No |

| Deed poll or board resolution |

Yes |

Yes |

| Insurance contract |

No |

Yes |

It should be noted that the rules of some pension schemes, particularly occupational pension schemes, may not allow lump sum death benefits to be paid to a trust.

Death in Service Schemes

Death in Service (DIS) schemes are written under pension rules and the death benefit nomination is exactly the same. This makes a spousal bypass trust the ideal home for large lump sum benefits from DIS schemes.

Spousal by-pass trusts are not limited to death in service benefits and pension benefits. They can be used in conjunction with any form of life insurance. Anyone with any type of term life insurance or mortgage protection insurance should consider placing the benefit of the policies into such a trust, though care must be taken to ensure that critical illness, cash value or other lifetime benefits are not included.

Are spousal bypass trusts too good to be true?

There are underlying complexities and issues to be aware of which makes it absolutely vital you get professional advice from a suitably qualified person. I have highlighted a number of points for consideration below.

– Access to the trust fund for your surviving spouse or civil partner is at the discretion of the trustees.

– The trust will be subject to its own IHT regime, currently a charge every 10 years of 6% and an exit charge but this is still likely to offer a considerable tax saving. The rules around this are known as ‘relevant property’ and apply to most types of trusts set up with only a few exemptions. I intend to visit this area again in a separate blog where the correct time and emphasis can be placed on this.

– A spousal bypass trust is likely to be more beneficial for uncrystallised pension funds than lump sum death benefits in respect of crystallised funds or post age 75 lump death benefits. This is as the latter two will be subject to a tax charge of 55 per cent. Previously, crystallised funds were subject to a 35 per cent tax charge, and therefore for higher rate tax payers this could have been more advantageous than receiving an income and paying tax at 40 per cent. Now that the tax charge on lump sums has increased to 55 per cent, taking an income has become relatively more attractive.

If a client enters into a capped drawdown arrangement, or post age 75, he can always provide a revised letter of wishes regarding his death benefits and state that his preference is no longer for the spousal by pass trust to receive the benefits on death.

– A bypass trust cannot be used with a Section 32 buyout plan or a retirement annuity contracts.

– The concept is a relatively simple one but as with most financial planning concepts their tends to be detail under the bonnet that requires professionally qualified, technical and professional people to set up and manage on your behalf. This is why it is vitally important to always seek advice.

How can advisers add value?

– Help your clients understand spousal trusts and their benefits in simple terms.

– Help fellow professionals to understand this potentially complicated area.

– Advice on how to maximise estate planning.

– Investment advice on monies held within a trust.

– Explain the responsibilities to trustees and hold their hands through the management of the trust.

By its very nature, inheritance tax will always be an issue that is loaded with emotion and sensitivities, often involving many members of family and loved ones. Not only does this subject make us all confront ‘The Inevitable’ in a very real way, it also makes us assess the legacy that we wish to leave behind – after all leaving a legacy is a very basic insticnt that we all share.

However, as I hope I have set out above, that emotional stress can be eased somewhat, and we can have greater peace of mind, by knowing that our estate planning has been carefully strategised by an independent professional and that our legacy will be implemented and managed as we desire.

Related

You May Also Like

South African Expat Tax Update 2024

South African expatriates should not only understand the newly implemented 2023/2024 tax laws, which aim at taxing their...

British Expats – please cancel your Premium Bonds now!!

“They are nowhere near as good as they used to be and now that you are an expat,...

Let’s learn quality control from manufacturing

Let’s learn quality control from manufacturing I’ve gone on record before saying the quality is never an accident....

DISCLOSURE:

mikecoady.com, the website, does not provide financial, investment or tax advice. It is specially designed to provide its users with general information. It does not give individual or specific advice on which products or services are the most appropriate for an individual’s particular circumstances. We may from time to time publish content on this site that has been created by affiliated or unaffiliated contributors.