Home How to Reset and Refocus your Investment Portfolio for 2022

How to Reset and Refocus your Investment Portfolio for 2022

|

Getting your Trinity Audio player ready...

|

A new year brings in new opportunities to grow and develop yourself, in all aspects of your life. These are normally quantified through new year’s resolutions or setting personal goals that you wish to achieve during the new year. Whilst a new year brings a proverbial clean slate, it is important to reflect on the previous year and take into account the impact that the previous year has had on your goals and objectives in order to manage your future expectations. Just as we set personal goals such as changing our diet, quitting smoking or changing our lifestyle, we also need to do the same for the financial aspects of our life. Below are some investment tips for 2022 that will allow you to reset and refocus your financial portfolio. You can also contact Mike for investment and wealth management advice.

Go back to the beginning – Many of our financial goals were set out years prior to last year. An example of this would be retirement planning, which can consist of decades of planning or alternatively specific goals that were set 5 years ago, such as the purchase of a property in 10 years’ time. It is important to reflect on what our long, medium and short-term financial objectives are and determine how all these objectives come together in the bigger financial picture.

Reflection – before we get too short-sighted about the flavour of the minute (such as Tesla or Bitcoin) and go all in, it is important to reflect on what our initial investment objective or strategy was and how relevant our current position is in relation to that strategy. Are we on track or do we need to make enhancements?

Upgrade your knowledge before your portfolio – Before making spontaneous, knee jerk adjustments to your portfolio (which can have a ripple effect down the line), it is important to understand what factors or events may have had an effect on:

· Your previous years’ financial performance

· Why these caused markets to behave the way they did

· The extent of the impact this had on your portfolio

· What financial constraints you may have experienced

· What you can do to improve your financial position or diversify your risk going forward

Once you have a better understanding of these factors and market fundamentals, you can then make an informed decision as to the best course of action to take in the new year.

Revamp – With points 1,2 and 3 in mind, it is important to make the necessary and relevant upgrades to your portfolio or refocus your financial objectives to ensure that your initial objectives are still attainable, realistic and within your original investment horizon. This can include a rebalancing of a portfolio, the addition of new funds, the omission of non-performing funds or a combination of the above. However, when revamping your portfolio, it is important to stick to your overall investment strategy, ensuring that any upgrades or enhancements put you in a position to achieve your financial objectives.

With these simple 4 steps mentioned above in mind, you should be in a better position to realign your investment portfolio in the new year in order to ensure it correlates with your financial objectives. This refocused approach is key to ensuring a concrete platform that will allow you to achieve your financial objectives and ensure you tick all the right boxes when it comes to evaluating your financial performance at the end of the year.

Remember, after witnessing the markets in 2021, there are some incredible opportunities out there, so seeking expert help will ensure you pick the best investments in 2022.

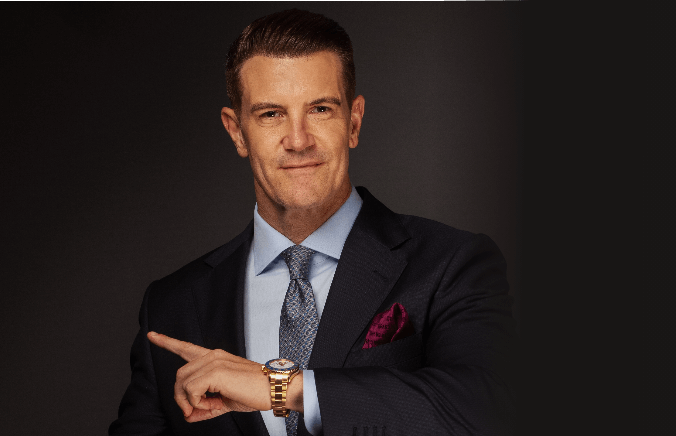

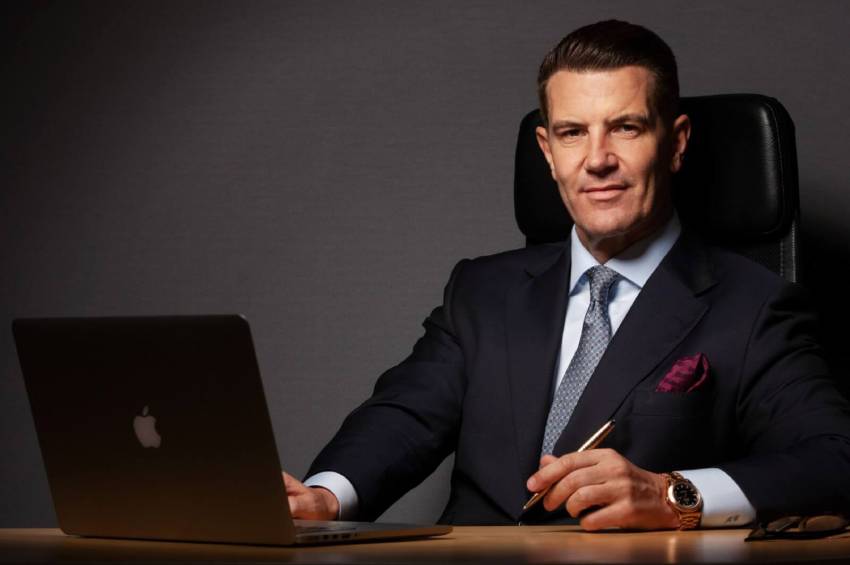

About Mike Coady

Mike Coady is an expat expert based in Dubai and is on hand to help with all of the above and more.

Mike is an award-winning money coach and industry leader in the financial sector.

Qualified to UK Financial Conduct Authority (FCA) standards, a member of the Chartered Insurance Institute, a Founding Fellow of the Institute of Sales Professionals (FF.ISP), a Fellow of the Institute of Directors (FIoD) and featured as a highly qualified Financial Adviser in Which Financial Adviser.

To learn how to choose a great financial adviser, download our free guide.

Blog published by Mike Coady.

Related

You May Also Like

43 Top Money-Saving Tips for Western Expats in the Middle East – A Comprehensive Guide

Navigating the cost of living as a Western expat in the Middle East can be a unique challenge,...

The Expat Investor’s Guide Beyond the S&P 500

Introduction Hello from Dubai! I'm Mike Coady, an experienced financial adviser and money coach. In my extensive interactions...

EXPATS: Why Bother with a Financial Adviser?

Introduction: Who needs a financial adviser, right? After all, managing complex financial matters such as wills, insurance, investments,...

DISCLOSURE:

mikecoady.com, the website, does not provide financial, investment or tax advice. It is specially designed to provide its users with general information. It does not give individual or specific advice on which products or services are the most appropriate for an individual’s particular circumstances. We may from time to time publish content on this site that has been created by affiliated or unaffiliated contributors.