Home Governments and OECD must do more to tackle ‘Wolf of Wall Street’ boiler-room scams, says deVere United Kingdom

Governments and OECD must do more to tackle ‘Wolf of Wall Street’ boiler-room scams, says deVere United Kingdom

Following the international ‘boiler room’ scam uncovered at the end of February in the UK, Spain, the U.S. and Serbia, deVere United Kingdom, the UK arm of deVere Group, is calling on the government, and the Organisation for Economic Cooperation and Development, amongst other institutions, to tackle this potentially devastating problem.

Referred to as ‘boiler-room’ scams, because of the typically simple premises they operate from, the scams run by these swindlers target individuals and blind them with persuasive sales talk, cheating them out of their savings with worthless stocks and shares. In the UK alone, over 850 victims have been detected so far, with some losing up to half a million pounds.

Much like the recent film The Wolf of Wall Street starring Leonardo DiCaprio, fraudsters working within the ‘boiler room’ scams usually enjoy lavish lifestyles, as a result of their illegal operations. Therefore as potential customers grow cautious of being duped by these con men, they may avoid seeking financial advice altogether, leaving the reputations of fully authorised, genuine companies, within the financial services sector irreparably damaged.

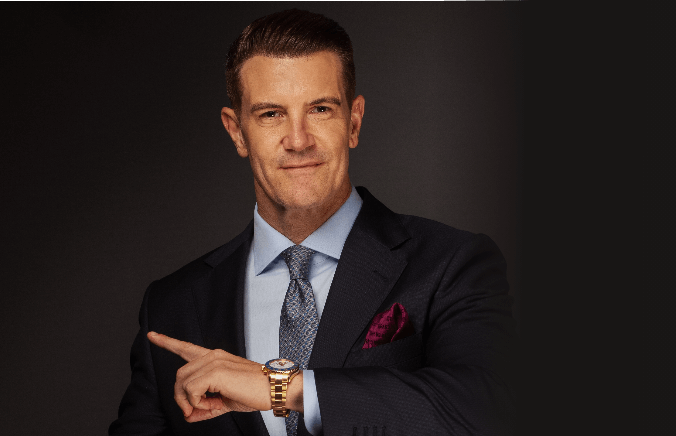

One such fully authorised, regulated company was deVere United Kingdom, which was targeted in an intricate cloning scam last year. Several illegal firms were found to be using the ‘deVere’ name in an attempt to cheat clients out of their wealth.

The fraudsters went to amazing lengths to copy deVere’s highly-respected brand, even making company stationery and personalised business cards to make them look as ‘genuine’ as possible. As a result, deVere has launched a number of public awareness campaigns recently in a bid to shield clients from potentially devastating losses of hard-earned savings. For example, deVere United Kingdom’s Kevin White was quoted in the FT Adviser as saying that the cheats were “using the identity of deVere UK to dupe unsuspecting people into investing large amounts of life savings based on their so-called advice, often using aggressive sales tactics”.

Similarly, Mitch Hopkinson, deVere United Kingdom’s Head of East Midlands, has gone on record to say: “One of my long standing clients recently contacted me saying why I hadn’t spoken to him about the fantastic investment that someone in deVere Group had contacted him about. Obviously taken aback, I asked him what it was and to my surprise it was something I didn’t know ‘we’ offered. After looking at the paperwork, it was a fraudulent investment using our company logo, on some badly made up headed paper and bond purchase order forms.”

If you believe you have been targeted by a suspected fraudster, the most important thing to do is to notify the police and Action Fraud. It’s advisable to be aware of anything that appears ‘too good to be true’, or requests to transfer funds to overseas accounts.

With this problem becoming a growing issue, it’s absolutely imperative that the government tackles it head on, and works closely with institutions likes the OECD as they have done on another serious global financial matter, such as tax evasion. ‘Boiler room’ scams devastate people’s lives, so working to eradicate them must be prioritised.

Related

You May Also Like

Choosing the right school for your Children

The UAE, particularly Dubai and Abu Dhabi, offers a multitude of educational opportunities for children, with a diverse...

A fortnightly look at global financial markets – 25 October 2016

The following is a detailed commentary and analysis from deVere Group’s International Investment Strategist, Tom Elliot regarding: Is...

Family Wealth Manager praises mentoring at Stapleford Park

When Albert Einstein said: “The only source of knowledge is experience” I believe he wasn’t too far away...

DISCLOSURE:

mikecoady.com, the website, does not provide financial, investment or tax advice. It is specially designed to provide its users with general information. It does not give individual or specific advice on which products or services are the most appropriate for an individual’s particular circumstances. We may from time to time publish content on this site that has been created by affiliated or unaffiliated contributors.