Home Global Financial Markets Outlook – January 2016

Global Financial Markets Outlook – January 2016

|

Getting your Trinity Audio player ready...

|

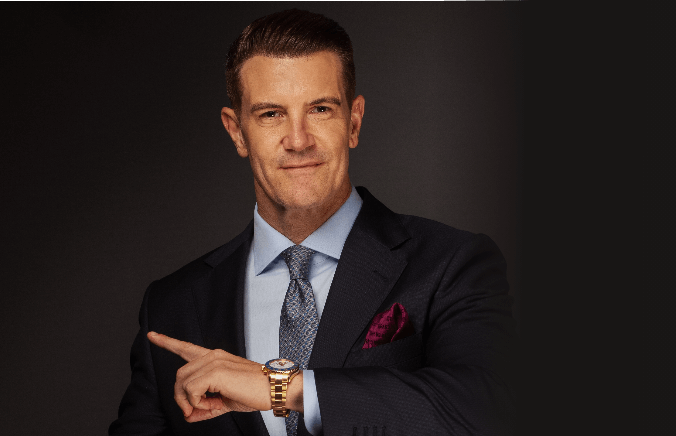

Every month deVere Group’s International Investment Strategist, Tom Elliott, will provide valuable insight into the global financial markets which will help you to keep abreast of opportunities and threats around the world.

Review

December was a difficult month for global stock markets, with the MSCI World stock market index down 1.8% in dollar terms, and 2.2% in local currencies.

This reflected a rise in global borrowing rates as the US Fed raised interest rates for the first time since 2006, and as high yield debt markets fell on fears of illiquidity in the market.

The ECB and Bank of Japan both relaxed their monetary policies further by tinkering with their QE programs, but this had little effect on investor sentiment.

Further evidence of weakness in the Chinese economy came with a poor PMI manufacturing survey at the end of the month. However, the same report showed much stronger confidence in the services sector, which will please the Chinese authorities as they attempt to steer the economy away from manufacturing and investment and towards household consumption and services.

Outlook

Global GDP growth in 2016 is likely to be similar to the approximately 3% year-on-year rate we saw last year, with the largest contributions again coming from China (if its official economic data is to be believed) and the U.S. By historic standards this is moderate global economic growth.

However, there are plenty of issues that may yet spook investors everywhere and cause volatility in global capital markets. Fear of a hard landing for the Chinese economy has already contributed to a rocky start to the year for global stock markets, and investors may also have to contend with the risk of policy error by the US Fed as it continues to raise interest rates.

Long term investors should sit still and remember that it is reasonable to expect long term annualised returns of 7.5% on a basket of global equities that tracks the MSCI All Country World index in dollar terms.

The main China risk is that a wave of debt defaults from the construction sector and from financial brokers leads to a banking crisis. The Beijing government will undoubtedly try to avoid this, but often bank crisis can occur too quickly for governments to control.

Another risk is that we see further Chinese currency devaluation in 2016, particularly if the dollar is pushed higher by Fed rate hikes. Falling import prices for Chinese manufactured goods may re-start fears of deflation throughout the West.

In the US the key political risk is that Donald Trump wins November’s presidential election. Neither business, nor investors, will find confidence in the mood of national self-pity and blind xenophobia that Mr Trump likes to foster.

A significant economic risk is that the US economy is not in a position to withstand the two 25bps rate hikes that the market anticipates from the Fed this year. It is noticeable that the CPI inflation number of just 0.5%, in November, is well below the Fed’s target of 2%.

UK stocks will fall if the country votes to leave the EU in a referendum that will take place later this year or early 2017. This is because of uncertainty over the shape of future trade deals, and the position that the country will take on broader political and economic issues.

Continuing weak commodity prices will provide a useful support to the economies of the G7 developed countries (excluding Canada). However, energy and mining producer countries will continue to suffer from weak export prices with unpredictable political, social and economic results.

The New Year upsurge in tension between Saudi Arabia and Iran is alarming, and risks turning the Middle East’s civil wars into one large Sunni / Shia confabulation. We must hope that wisdom prevails, and that Mr Trump is not in a position this time next year to add his contribution.

What should investors do?

Capital preservation is the main theme for 2016. This means defensive positioning in a truly diversified portfolio of assets that contains equities, bonds and some cash (dollars, preferably).

Core Government bonds such as Treasuries, gilts and bunds are currently unfashionable. But they do rally in poor economic data, threats of deflation and global political instability.

Within equities, euro zone and Japanese stock markets look set to outperform the US and UK markets, thanks to continuing loose central bank monetary policy which will keep the euro and the yen weak against the dollar, enabling strong corporate earnings growth.

US equity valuations makes them vulnerable to any disappointment in corporate earnings, while the UK FTSE 100 index appears vulnerable to cuts in dividends from some of the most venerable, if not anymore the largest, constituents.

Investors should remain focused on the long-term benefits of sticking with stock market investments as a way of preserving capital and – with a possible 7.5% annual return over the next 15 to 20 years- making real capital gains.

*JP Morgan Asset Management ‘Long-term capital market assumptions’, December 2015

Click here for my LinkedIn profile and Twitter account.

Related

You May Also Like

Choosing the right school for your Children

The UAE, particularly Dubai and Abu Dhabi, offers a multitude of educational opportunities for children, with a diverse...

A fortnightly look at global financial markets – 25 October 2016

The following is a detailed commentary and analysis from deVere Group’s International Investment Strategist, Tom Elliot regarding: Is...

Family Wealth Manager praises mentoring at Stapleford Park

When Albert Einstein said: “The only source of knowledge is experience” I believe he wasn’t too far away...

DISCLOSURE:

mikecoady.com, the website, does not provide financial, investment or tax advice. It is specially designed to provide its users with general information. It does not give individual or specific advice on which products or services are the most appropriate for an individual’s particular circumstances. We may from time to time publish content on this site that has been created by affiliated or unaffiliated contributors.