Home J.P. Morgan, JPM Fusion Fund range launched through deVere Group

J.P. Morgan, JPM Fusion Fund range launched through deVere Group

J.P. Morgan Asset Management recently launched JPM Fusion Fund range through the deVere Group.

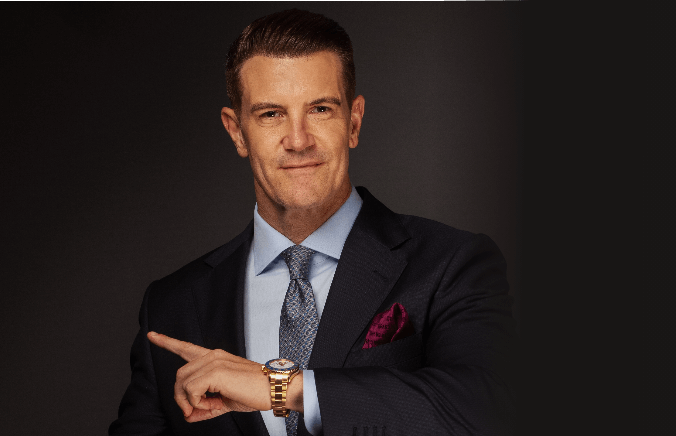

Here, I speak with J.P. Morgan Asset Management’s Head of Sales & Advisor Solutions, Jamie Farquhar, who has been integral in the launch of the J.P. Morgan’s Fusion Fund range.

How does the new Fusion Fund range differ from other JP Morgan investment strategies?

We’re excited to launch a new fund range for a new market that incorporates the full breadth and depth of the portfolio management skills within J.P. Morgan Private Bank. We have a great pedigree, heritage and history, borne of looking after the world’s wealthiest individuals for over 160 years. J.P. Morgan Asset Management’s skill set has been focussed on single strategy funds in the past. The JPM Fusion Fund range brings J.P. Morgan Private Bank’s long standing multi-fund expertise to the retail market for the first time.

How will the Fusion fund range help an adviser serve the needs of his or her clients?

The market is certainly cluttered with fund of fund players, both old and new but J.P. Morgan has certainly taken a different path with the Fusion Range. Rather than taking existing funds and asking asset risk consultancies to risk rate them, J.P. Morgan has specifically designed a range of funds that will be monitored by two independent groups on a quarterly basis, to help ensure that they continue to meet suitability requirements of the clients. This helps advisers to deliver investment advice with confidence that stretches beyond pure brand.

What would be your expectations and conditions of the global markets for the second quarter of 2013 and beyond?

The global economic recovery continues at a muted yet stable pace with some definite room for upside in the second half of the year. Developed market equities continue to be buoyed by unprecedented levels of policy stimulus from Central Banks across the U.K., the U.S., Europe, and most recently the Bank of Japan has announced bold measures to stimulate growth and combat deflation. All of this is amid an absence of inflationary pressure while both corporate and consumers retain healthy cash positions. We feel these conditions should set the stage for markets to be less dependent upon macro driven headlines and allow investors to return to a focus on fundamental value and specific drivers of opportunities.

Where would JPM Fusion envisage upside potential and how would this effect investment strategies?

We launched the Fusion Funds at normal levels of equity risk but expect to add value through overweight or underweight positions within the individual asset classes. Emerging Markets represent our largest out of benchmark allocation, with a tilt towards Asia ex-Japan and the domestic consumer. Despite the year-to-date underperformance of the region relative to the rest of the world, we believe emerging markets should benefit as equity valuations and economic growth prospects are favourable, both relative to history and to developed markets. We see further upside in equity markets over the next 12 months and would look to use any market weakness resulting from the current economic soft patch as buying opportunities to add to equities.

Within fixed income allocations, we are underweight core bonds in favour of high yield and emerging market debt. We would look to trim our high yield allocations to add to nominal equities should we see buying opportunities.

Why do you believe JP Morgan and deVere Group reached an agreement to offer the Fusion fund range to deVere’s clients?

Simple for me. – It’s the people. Both J.P. Morgan and deVere are passionate about what they do and this is encapsulated in the relationships that exist between the individuals that work for the two groups. deVere are committed to providing the highest levels of service to their clients. The team at J.P. Morgan aspire to match this with a first class service delivered in a first class way.

Related

You May Also Like

Choosing the right school for your Children

The UAE, particularly Dubai and Abu Dhabi, offers a multitude of educational opportunities for children, with a diverse...

A fortnightly look at global financial markets – 25 October 2016

The following is a detailed commentary and analysis from deVere Group’s International Investment Strategist, Tom Elliot regarding: Is...

Family Wealth Manager praises mentoring at Stapleford Park

When Albert Einstein said: “The only source of knowledge is experience” I believe he wasn’t too far away...

DISCLOSURE:

mikecoady.com, the website, does not provide financial, investment or tax advice. It is specially designed to provide its users with general information. It does not give individual or specific advice on which products or services are the most appropriate for an individual’s particular circumstances. We may from time to time publish content on this site that has been created by affiliated or unaffiliated contributors.